The following article by Ryan Koronowski was posted on the ThinkProgress website June 13, 2018:

The federal government just admitted that workers are earning lower wages since the passage of the GOP tax cuts.

When President Donald Trump was pushing Congress to pass his tax plan last year, which focused on lowering corporate rates and the income taxes of high earners, he pulled out a handy statistic: according to the president’s Council of Economic Advisers, the average family would make $4,000 more under the new plan.

Trump repeatedly used this figure to argue for the bill prior to its passage in December 2017, as well as directly after. During a February 2018 speech in Ohio, he claimed “economists estimate that our business tax cut will raise the income of a typical family by an average of $4,000.” Vice President Mike Pence has repeated that talking point, as have others in the White House.

On Tuesday, the Bureau of Labor Statistics issued a new release detailing the “real earnings summary” through May 2018.

The true revelation was tucked away at the bottom of the release, in the “Production and nonsupervisory employees” section: “From May 2017 to May 2018, real average hourly earnings decreased 0.1 percent, seasonally adjusted,” it read.

In today’s dollars, that’s a change from making an average of $22.62 per hour last May to making $22.59 per hour this May.

The report continued, “The decrease in real average hourly earnings combined with a 0.6-percent increase in the average workweek resulted in a 0.5-percent increase in real average weekly earnings over this period.” In other words, people are working a few more hours a week, so they’re taking home more pay, but only marginally.

The entire rationale behind the tax cut was to boost Americans’ wages. But the BLS numbers prove that workers who are not bosses and who produce things are in fact making less for their time than they did last year.

Center for American Progress policy analyst Alex Rowell constructed a chart based on the BLS data, showing the steep decline since 2015 in year-over-year annual hourly wage earnings for production and non-supervisory employees. (ThinkProgress is an editorially independent newsroom housed within the Center for American Progress.) Production and nonsupervisory employees make up 80 percent of private employment, according to Rowell.

Averages tell only part of the story. The raises that high earners receive could represent a huge portion of any average wage growth increase, while low-income earners pull in less than they did before. Median earnings data would give a better picture of what most people are experiencing.

Taking into account all employees — including bosses and non-production employees — the year-to-year change in real wages was flat from May 2017 to May 2018. Real average hourly earnings for both groups increased 0.1 percent from April 2018 to May 2018.

In real terms, the average worker made $10.75 per hour in May and $10.74 per hour in April.

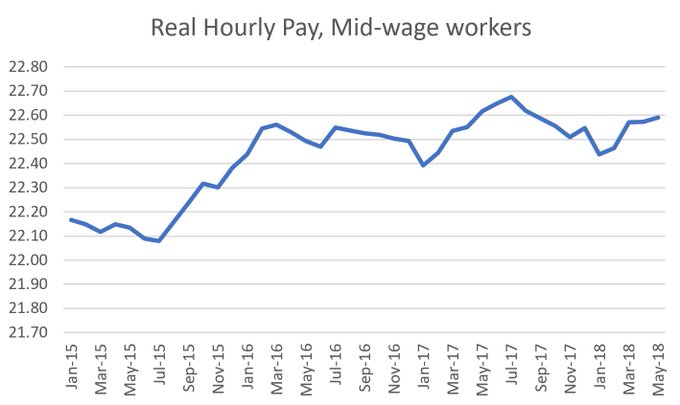

According to Jared Bernstein of the Center on Budget and Policy Priorities, since Trump took office, the “real hourly pay of mid-class workers” is only up 0.4 percent, which amounts to “an extra dime an hour.”

“At this rate, that tax-cut induced $4,000 in your paycheck will take 28 years,” Bernstein wrote.

Part of the reason wages are not rising is that inflation has now hit a six-year high, which eats into what workers earn.

However, the main problem is that the largest focus of the tax cut plan was targeted at corporations and the wealthiest Americans. The people who run companies like AT&T, Wells Fargo, and Comcast began a public push, helped along by the White House and Republicans in Congress, to hype up the bonuses they were awarding to their workers — the clearest demonstration of “trickle-down” economics available. However, the total of those announced bonuses totaled roughly $981 million, while the cost of the tax bill was actually $1.4 trillion, meaning workers got only 0.9 percent, according to analysis by ThinkProgress.

Many of those business, including Walmart, touted the bonuses they were giving just as they were using their tax savings to offer stock buybacks to shareholders and to offset the cost of closing stores where thousands of people worked. In a USA Today op-ed titled, “That $4,000 raise Donald Trump and Paul Ryan promised you was a trickle-down lie,” venture capitalist and entrepreneur Nick Hanauer explained, “Businesses don’t give raises just because they got a tax cut.”

And because the bonuses only happen once, workers won’t get more unless yearly wages rise — which they haven’t been, according to the federal government’s own data.

UPDATE: This post has been clarified to use today’s dollars for estimates of average wages for production and nonsupervisory employees instead of the 1982-1984 base year dollars used in the BLS estimate.